The Macroeconomic Impact of Trade Tariff Uncertainty on Automotive Consumer Behavior

The looming threat of renewed trade tariffs has introduced a significant variable into the automotive sales ecosystem, forcing immediate, though often unpredictable, changes in consumer purchasing behavior. As an Automotive Market Strategist and Economic Analyst, this report analyzes the divergence between current market indicators and forward-looking consumer sentiment, detailing the systemic risks posed by prolonged policy volatility on the vehicle transaction landscape.

I. Divergence of Market Fundamentals and Consumer Sentiment

Despite persistent geopolitical uncertainty, the immediate financial impact of potential trade tariffs on the average transaction price (ATP) has been less disruptive than forecasted. Analysis of recent transaction data reveals that pricing trends have largely maintained seasonal elasticity. For instance, the new vehicle ATP in April 2025 stood at $48,422, reflecting a 2.2% year-over-year increment from April 2024 ($47,385), consistent with normalized inflationary pressures and manufacturer pricing strategies. While selected models have experienced targeted Manufacturer’s Suggested Retail Price (MSRP) adjustments or restrictions in allocation due to tariff concerns, these actions have not yet translated into widespread market inflation or a systemic collapse in vehicle demand.

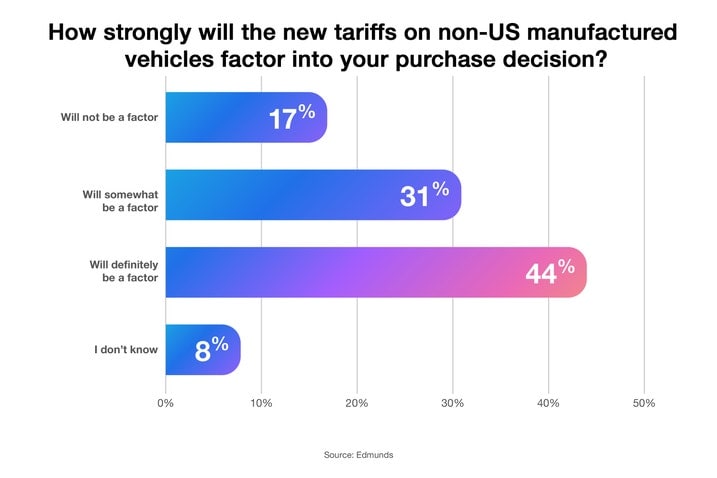

However, the lack of immediate systemic financial disruption does not reflect consumer preparedness. Survey data indicates that a significant majority of prospective buyers are already adjusting their procurement timelines based on tariff speculation. Approximately 44% of in-market shoppers reported that tariffs will definitely influence their decision, with an additional 31% stating they will somewhat factor in. This high level of perceived influence—where over 75% of the consumer base is factoring in an uncertain economic policy—suggests that market disruption will stem more from consumer psychology and preemptive actions than from finalized policy changes.

II. The Psychology of Procurement Volatility

Consumer response to policy uncertainty is bifurcated, driven by the perceived risk of future price hikes. This phenomenon is categorized by two contrasting behavioral responses:

A. The "Pull-Ahead" Purchase Phenomenon

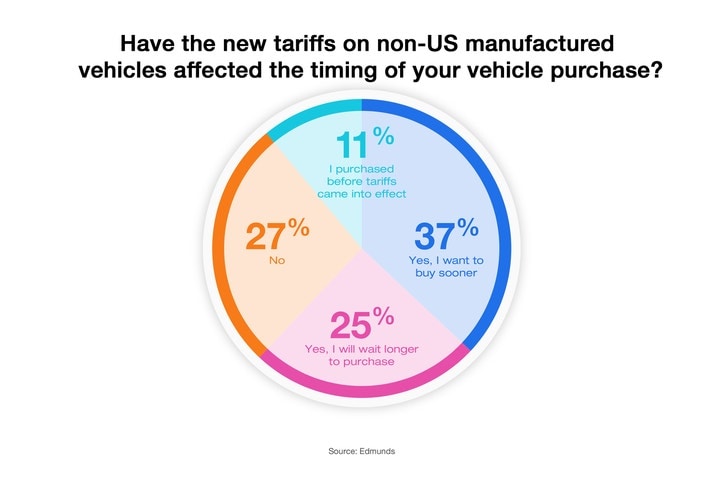

The anticipation of higher acquisition costs has triggered a pull-ahead mechanism, where consumers accelerate their procurement timeline to secure pre-tariff pricing. Data from early Spring 2025 showed elevated buying activity relative to seasonal forecasts, a behavior often mirrored in periods preceding regulatory or inflationary shifts. This strategic acceleration contributed to a seasonal lift in broader market indicators, such as the Seasonally Adjusted Annual Rate (SAAR). The primary driver here is the consumer's perceived risk—a calculated gamble that the cost of immediate purchase is lower than the projected cost of delay.

B. The Procurement Delay Strategy

Conversely, a substantial segment of the market (25% in recent polling) has opted to delay procurement. This behavior is typically driven by risk aversion and the hope that policy uncertainty will resolve favorably, potentially leading to lower final pricing, or at least clearer pricing signals. The decision to delay creates inherent volatility, as dealers and OEMs struggle to forecast accurate demand when consumer timelines are decoupled from typical seasonal and incentive structures.

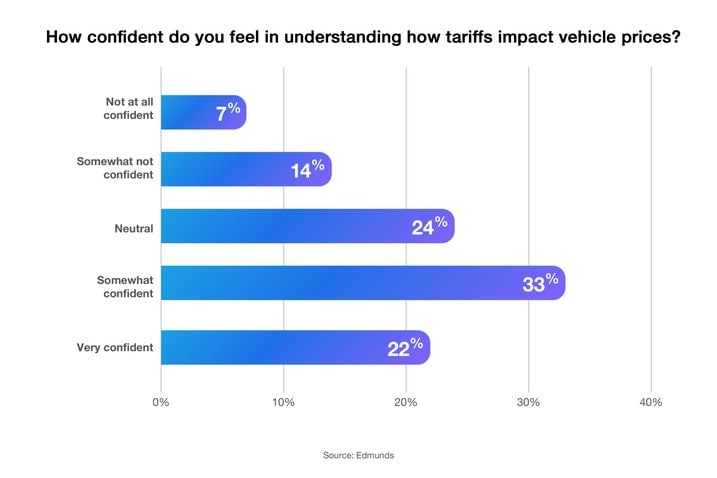

C. Confidence and Market Turbulence

A majority of shoppers (55%) express confidence in their understanding of how tariffs might affect vehicle pricing. Whether this confidence is empirically justified or based on speculative media reports, this high level of perceived awareness is expected to amplify market turbulence. Expert Augmentation: High consumer confidence combined with high policy uncertainty creates a situation prone to unpredictable market overreactions, making traditional forecasting models, which rely on stable emotional and informational input, functionally obsolete.

III. Strategic Consumer Migration to the Pre-Owned Segment

A key observable shift is the migration of demand toward the used vehicle market, perceived by consumers as a potential hedge against new-vehicle price escalation. Since March 2019, new vehicle ATPs have already increased by 29%—a foundational price hike that precedes any tariff impact—making the pre-owned segment inherently more appealing.

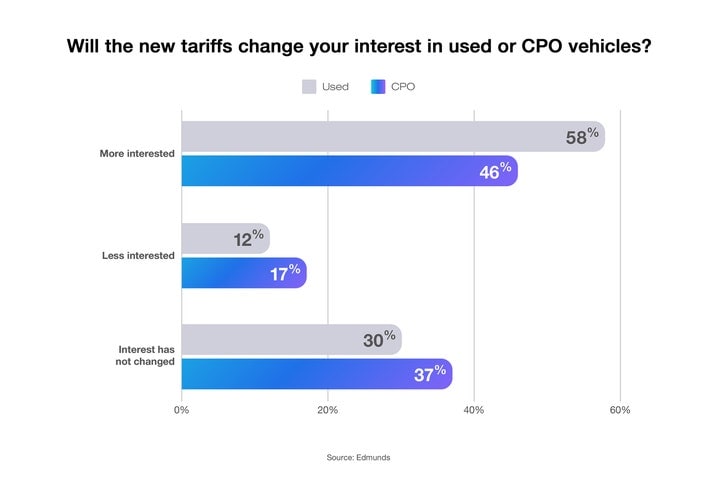

A. Segment Preference Shift

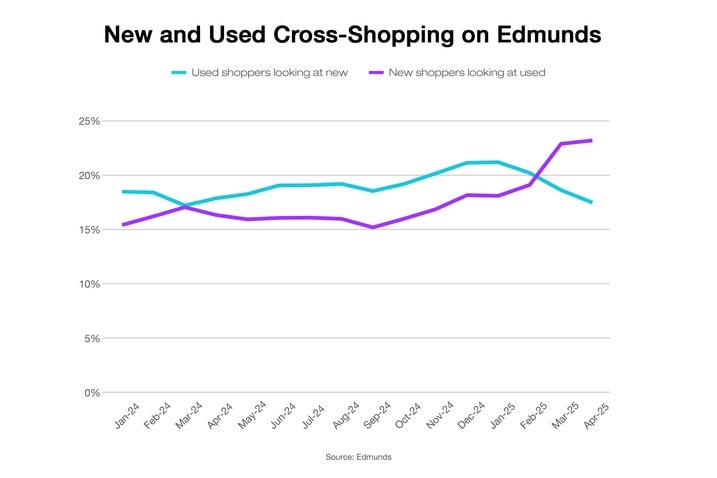

Survey data confirms this trend: 58% of respondents expressed heightened interest in used vehicles, with 46% specifically considering the Certified Pre-Owned (CPO) segment. CPO vehicles offer manufacturer-backed assurance, presenting a mitigated risk alternative to purchasing a new vehicle facing potential tariff-induced depreciation or pricing instability. Site analytics corroborate this sentiment, showing a measurable rise in new-car shoppers concurrently browsing pre-owned inventory.

B. Market Constraints and Secondary Price Pressure

This surge in demand for the pre-owned segment is complicated by severe supply side constraints. The historically low leasing volumes during the peak microchip shortage period (approximately three years prior) are now manifesting as a limited inventory of near-new used vehicles available for remarketing. This bottleneck in supply, coinciding with elevated demand, will inevitably introduce upward pressure on used vehicle pricing. This secondary price inflation diminishes the strategic relief sought by consumers migrating from the new car market, ultimately creating a challenging procurement environment across both segments.

IV. Strategic Imperatives for OEMs and Dealerships

The tariff anticipation environment has shifted the psychological dynamic of the purchasing process, replacing typical consumer excitement with financial anxiety and second-guessing. This disruption presents unique challenges for industry stakeholders.

A. Demand Forecasting Complications

Traditional demand forecasting models, reliant on predictable seasonality and historical trend analysis, are losing their predictive accuracy when consumer timelines are subject to policy-driven volatility. OEMs and dealerships face increased difficulty in inventory management, incentive planning, and capital allocation.

B. The Geopolitical Buffer Strategy

Expert Augmentation: Automakers possessing the broadest global manufacturing footprint and the most efficient, localized cost structures are strategically best positioned to withstand protracted policy volatility. The ability to quickly shift allocation or assembly locations, or to minimize reliance on heavily tariffed imported components, serves as a critical geopolitical buffer against trade policy shifts. This structural agility becomes a determinant factor in maintaining competitive pricing and stable supply, overriding traditional metrics of brand loyalty or product performance alone.

C. Navigating LSI Keywords and Consumer Search Behavior

The current market dictates that marketing teams must prioritize LSI (Latent Semantic Indexing) keywords related not just to vehicles, but to economic mitigation strategies. Search terms often include "avoid tariff car price hike," "new car pricing uncertainty," and "certified pre-owned cost." Content strategies must pivot to address the underlying financial anxiety rather than just product features.

V. Interactive FAQ: Tariff Impact on Automotive Procurement

How does tariff anticipation create market volatility if prices haven't significantly moved?

Market volatility is driven by consumer sentiment and perceived risk, not just immediate pricing data. The fear of future price hikes triggers bifurcated behavior (pull-ahead purchases versus delays), which disrupts traditional demand forecasting and inventory management for OEMs and dealers. This disruption in sales cadence is a form of volatility independent of the Average Transaction Price (ATP).

Why are Certified Pre-Owned (CPO) vehicles a strategic alternative?

CPO vehicles are strategically attractive because their acquisition cost is generally insulated from immediate import tariff adjustments, offering a mitigated risk against new-vehicle price inflation. Furthermore, the CPO assurance package provides manufacturer backing, offering a perceived higher value proposition compared to standard used vehicles in an environment where financial decision-making is clouded by uncertainty.

What is the primary risk of the current tight used vehicle inventory?

The primary risk is secondary price pressure. The migration of demand from the new to the used market, combined with the lingering supply bottleneck (a consequence of low leasing volumes three years ago), inevitably leads to higher pricing for used and CPO segments. This undermines the consumer's strategic move to find financial relief, creating an overall challenging procurement environment across all vehicle segments.

LSI Keywords used: Average Transaction Price (ATP), consumer sentiment, procurement timeline, pull-ahead, Certified Pre-Owned (CPO), supply side constraints, secondary price inflation, demand forecasting.

Posting Komentar untuk "The Macroeconomic Impact of Trade Tariff Uncertainty on Automotive Consumer Behavior"